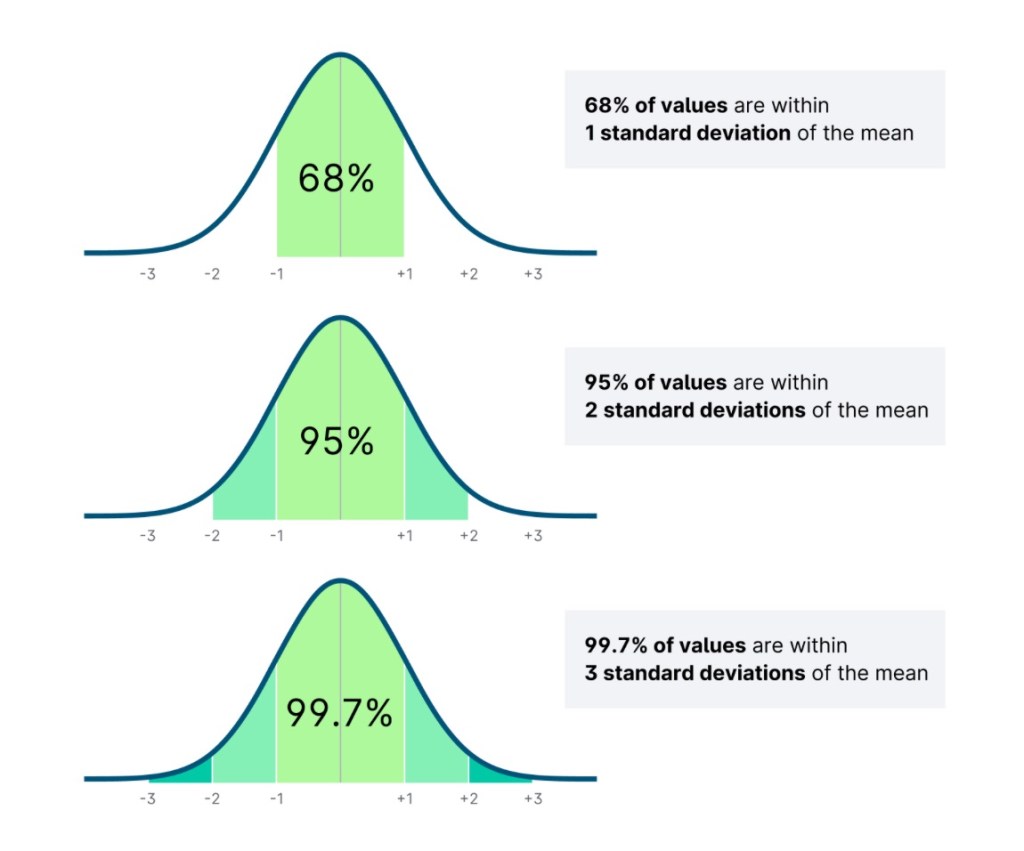

Tail risk is defined as the possibility that return will be more than three standard deviations from the mean, which means it’s targeting observations with 0.3% (=100-99.7) odds of happening. While a probability of 0.3% seems extremely low, left tail events have historically decimated portfolios, especially if the impact of the triggering event lasts for some time.

There are three distinct sides of risk:

• The odds you will get hit.

• The average consequences of getting hit.

• The tail-end consequences of getting hit.

The first two are easy to grasp. It’s the third that’s hardest to learn, and can often only be learned through experience.

Tail-end events are all that matter.

Once you experience it, you’ll never think otherwise.

Morgan Housel

Leave a comment